Mahindra Lifespaces unveils India’s first home buying experience on the Metaverse

SOURCE: HTTPS://INDIATECHNOLOGYNEWS.IN/

OCT 31, 2023

Unity Software: The Metaverse can be a game changer

SOURCE: SEEKINGALPHA.COM

OCT 12, 2021

Unity Software (U) is one of the companies that is better positioned to benefit from the development of the metaverse, a technology that can be a game-changer for its business and make it a much larger company over the next decade.

Unity is a technology company offering a leading platform for creating and operating interactive, real-time 2D and 3D content. This is used for several applications, such as mobile gaming or filmmaking, but also for augmented and virtual reality devices (AR/VR).

The company was founded in 2004 and has only been listed since last year, while its current market value is about $38 billion.

One of the company’s key strengths is mobile gaming, where according to Apptopia (which measures Unity’s market share across the iOS App Store and the Google Play store) about 65%-70% of the world’s top 1,000 mobile games are developed using Unity’s software.

Unity’s platform enables large game developers or smaller companies to create and operate high-quality games in an efficient and fast way. Games developed using its platform can be deployed across several applications, such as PlayStation, Xbox, iOS, Android, Windows, beyond others.

Unity says that it has billion of users, but investors should be aware that these are not its free or paying customers, it is the total number of end-users (people that play games that were developed using Unity) so this statement can be somewhat misleading.

Indeed, at the end of 2020, close to 800 customers represented the vast majority of its revenues, with no single customer generating more than 10% of its revenues. By geography, Unity’s revenues are well diversified across North America, Asia-Pacific and EMEA (Europe, Middle East and Africa), with each region representing about one-third of total annual revenues.

Its game-engine software has highly recurring revenues, boding well for revenue growth in the coming years, plus it also offers operating solutions like in-game advertising that should also increase its total revenue per customer.

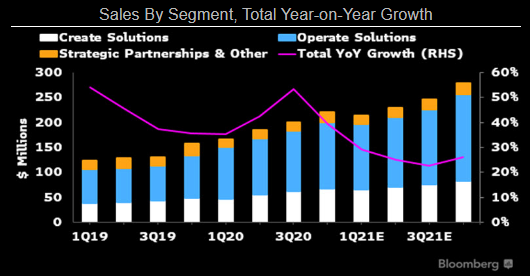

Indeed, its platform consists of two sets of solutions, its Create Solutions and Operate Solutions. In Create, content creators use Unity’s software to develop 2D and 3D content, generating revenue through monthly subscriptions. In Operate, Unity offers customers the ability to monetize their content, while Unity generates revenue from revenue-share and usage-based models. This means that Unity makes more revenue as its customers grow and increase engagement with users, being a recurring revenue stream over the long term.

Moreover, the two solutions are closely linked, as subscriptions to its Create Solutions are the main driver of adoption for Operate Solutions. This is a very good business model as revenue per existing customer is expected to increase over time and has a highly recurring profile. In 2020, Unity’s Operate Solutions was the biggest revenue driver, generating some 61% of total revenues.

Source: Bloomberg.

While gaming is its most important business line, Unity also has good growth opportunities in different industries, like architecture, automotive or construction. In these areas, Unity's platform is used for different applications including building or automotive design, helping developers to improve the creation process and reach better solutions than using traditional methods.

This background is quite positive and gives Unity good growth prospects over the coming years, but even more exciting over the long haul are its capabilities in AR/VR that can really boost its business in the future.

Unity has good growth prospects in its current businesses, but its growth can truly explode with the metaverse. As the company has a leading platform for real-time 3D content that is used in AR/VR devices, it can benefit immensely from the development of the metaverse.

As I’ve discussed previously in an article on Facebook (FB), the metaverse is still in its infancy but has a lot of potential to change our lives. The metaverse can be seen as the ‘internet 2.0’, where people will get a sense of being part of a virtual world and can be quite disruptive from what is today the internet.

The metaverse is a virtual environment where people can be together in digital spaces, where people can be embodied rather than just looking at. A critical technology to achieve this is AR/VR, which enable people to hang out, play games, work, and more in an immersive game-like world.

The metaverse has the potential to be a disruptive technology that will change the way we connect ourselves today, creating vast opportunities for several companies to profit from this creation. Indeed, the metaverse is not expected to be developed solely by one company, but rather a technology that is built through collaboration of different skills. Companies like Unity or Nvidia (NVDA), which have strong graphic capabilities, should play a critical role in the development of the metaverse.

The same way that companies have web pages nowadays on the internet, in the future these firms will have a real-time presence in the metaverse. For example, imagine taking a virtual ride in Disney’s (DIS) virtual theme parks.

This digital world will spark a new economy, as it can potentially be used by billions of people and create a lot of opportunities for businesses to make money on the metaverse, as the total addressable market will be huge as people will not need to leave home to visit a Disney theme park, for instance.

This will also create a lot of demand for Unity’s software, to create digital worlds of pretty much everything you can imagine. This will take time to develop and is not expected to be mainstream over the next few years, but over the long term the potential is enormous and Unity is one of the companies that will certainly benefit from this disruptive technology.

On the other hand, investors should be aware that is not certain that the metaverse will be successful, at least beyond gaming, and AR/VR headsets are still somewhat expensive being a barrier to vast adoption of this technology.

Nevertheless, the metaverse can be really transformative and if it develops to be the ‘next big thing’ it will most likely be a huge tailwind for Unity’s growth over the next decade.

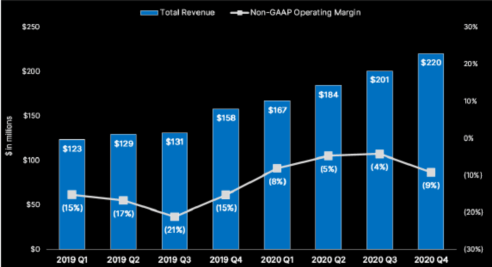

Regarding its financial performance, Unity’s history is quite good even though this is a company in a very early growth phase and, unsurprisingly, it is still not making money.

However, its revenue growth has been quite good over the past couple of years, reporting annual revenue growth above 40%. Its revenues amounted to $772 million in 2020, more than double its 2018 level. Its net profit during the past three years was negative, reporting $282 million in losses in 2020, including $134 million of stock-based compensation expense.

Source: Unity.

During the first six months of 2021, Unity maintained a good momentum with revenue of $274 million in Q2 2021, surpassing $1 billion annual revenue run rate for the first time. Its revenues increased by 48% YoY in the past quarter, showing that Unity’s growth is not slowing down. For the full year, Unity expects annual revenues to be slightly higher than $1 billion, which implies annual revenue growth of about 37% YoY.

Its gross margin was 81%, an improvement of 300 basis points compared to the same quarter of 2020, and over the long term, the company expects gross margin to be above 70%. Its non-GAAP operating loss was $3.2 million in the quarter.

Going forward, Unity is expected to maintain strong revenue growth around +30% YoY during the next four years, but when it will reach break-even is quite uncertain and most likely will not happen in the next two to three years as the company will continue to invest significantly on research and development.

Regarding its balance sheet, Unity has a solid position due to its cash raised in its IPO last year, which is enough to finance its operations over the next few years. At the end of June 2021, Unity has a net cash position of about $1.5 billion, which seems comfortable to cover near-term cash burn and do some small acquisitions without raising new equity at least in the next two to three years.

Unity is a high-growth company and its prospects are quite good in its existing business, boosted by gaming and other applications of real-time 3D content. This by itself is already quite interesting, but the potential of the metaverse can be truly game-changing and can help Unity’s growth become exponential.

However, investors should be aware that this may take some time to happen, so Unity is clearly an investment for long-term investors that believe the metaverse will become reality over the next five to ten years.

At this point, Unity’s valuation seems to be fair at 33x revenues, considering its annual revenue growth profile, but investors should see this stock as a long-term bet on the metaverse and therefore current valuation should not be the main reason to buy this stock, or not.

LATEST NEWS

WHAT'S TRENDING

Data Science

5 Imaginative Data Science Projects That Can Make Your Portfolio Stand Out

OCT 05, 2022

SOURCE: HTTPS://INDIATECHNOLOGYNEWS.IN/

OCT 31, 2023

SOURCE: HTTPS://FINANCE.YAHOO.COM/

SEP 28, 2023

SOURCE: HTTPS://MEDIABRIEF.COM/

SEP 22, 2023

SOURCE: HTTPS://WWW.BUSINESS-STANDARD.COM/INDIA-NEWS/METAVERSE-WEB3-MARKET-TO-GROW-40-ANNUALLY-TO-REACH-200-BN-BY-2035-123060200394_1.HTML

JUN 28, 2023

SOURCE: HTTPS://WWW.WIRED.COM/STORY/WHAT-IS-THE-METAVERSE/

JUN 20, 2023