AI language models could help diagnose schizophrenia

SOURCE: HTTPS://WWW.SCIENCEDAILY.COM/

OCT 09, 2023

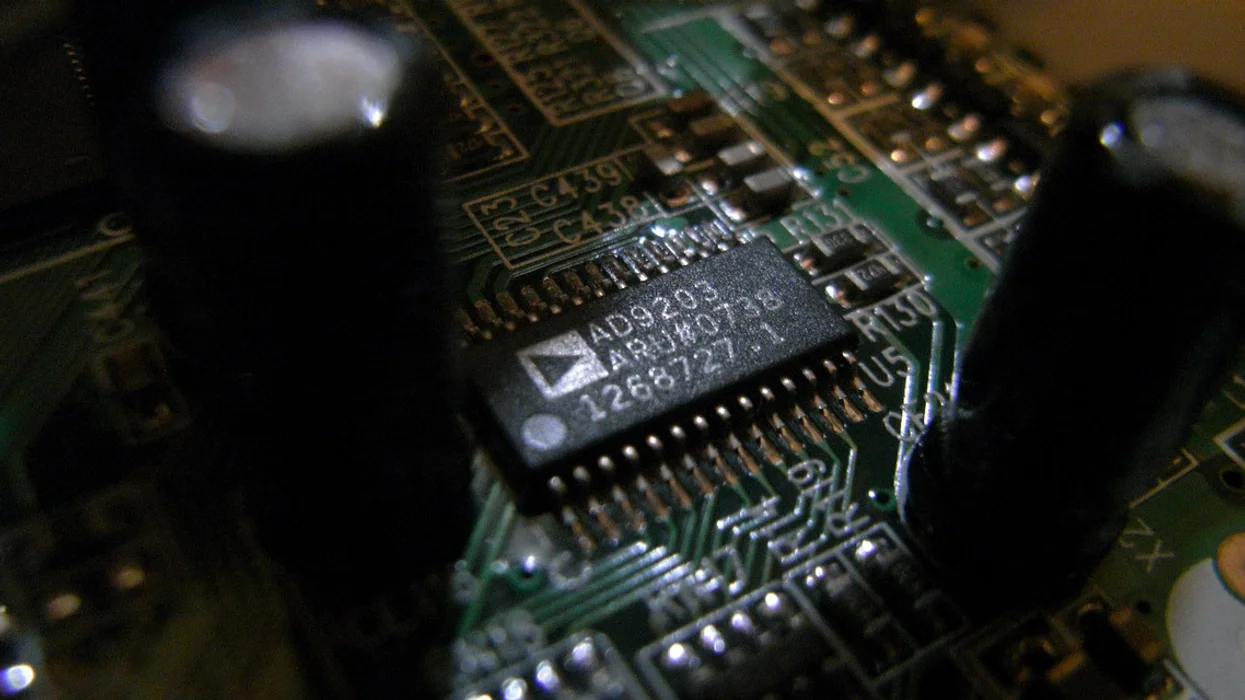

The AI chip startup boom

SOURCE: PROTOCOL.COM

APR 15, 2022

Hello and welcome to Protocol Enterprise! Today: how demand for AI chips has led to a surge in chip investing, why federated containers are poised to take over enterprise tech, and how not to conduct security training.

The modern enterprise tech landscape doesn’t exist without open-source software, but as we’ve learned over the past year, securing and managing open-source software is a huge challenge. According to new research from Tidelift, only 15% of companies are “extremely confident” in their open-source management practices, while 22% are “not very” or “not at all” confident in that discipline.

The raw computational power necessary to use machine learning has dwarfed everything else we use computer chips to accomplish by an order of magnitude. And that appetite for power has created a booming market for chip startups for the first time in years and helped double venture capital investments over the past five years.

AI market leader Nvidia estimates that most machine-learning or AI tasks have spurred a 25-fold increase in the need for processing power every two years, while one of the most advanced natural-language-processing models needs 275 times the compute power every two years to work. The boom has also created opportunities for a new breed of chip company, one that is focused on making specialized chips for AI.

Prior to 2015 only a small handful of venture capitalists saw the opportunity that AI presented, and there was little overall interest in funding chip companies.

With the advent of artificial intelligence has come a resurgence in semiconductor investing.

“I’m looking for companies that are offering a fundamentally different use case,” Lux Capital partner Shahin Farshchi said. As an example, Farshchi offered the firm’s portfolio company Mythic, which uses an older chip technology to make a chip that performs AI processing at a fraction of the power required to run the type of typical graphics chip that’s used in data centers.

— Max A. Cherney (email | twitter)

LATEST NEWS

WHAT'S TRENDING

Data Science

5 Imaginative Data Science Projects That Can Make Your Portfolio Stand Out

OCT 05, 2022

SOURCE: HTTPS://WWW.SCIENCEDAILY.COM/

OCT 09, 2023

SOURCE: HTTPS://WWW.THEROBOTREPORT.COM/

SEP 30, 2023

SOURCE: HTTPS://WWW.SCIENCEDAILY.COM/

AUG 08, 2023

SOURCE: HOUSTON.INNOVATIONMAP.COM

OCT 03, 2022

SOURCE: MEDCITYNEWS.COM

OCT 06, 2022