‘World’s 1st’ flamethrower robot dog gets remote control and LiDAR

SOURCE: HTTPS://INTERESTINGENGINEERING.COM

APR 24, 2024

Nauticus Robotics closes SPAC deal and makes NASDAQ debut

SOURCE: THEROBOTREPORT.COM

SEP 15, 2022

Nauticus Robotics completed its business combination with CleanTech Acquisition Corp, a special purpose acquisition company (SPAC) formed in June 2020. Nauticus also made its debut on the NASDAQ under ticker symbols “KITT” for its common stock and “KITTW” for its public warrants.

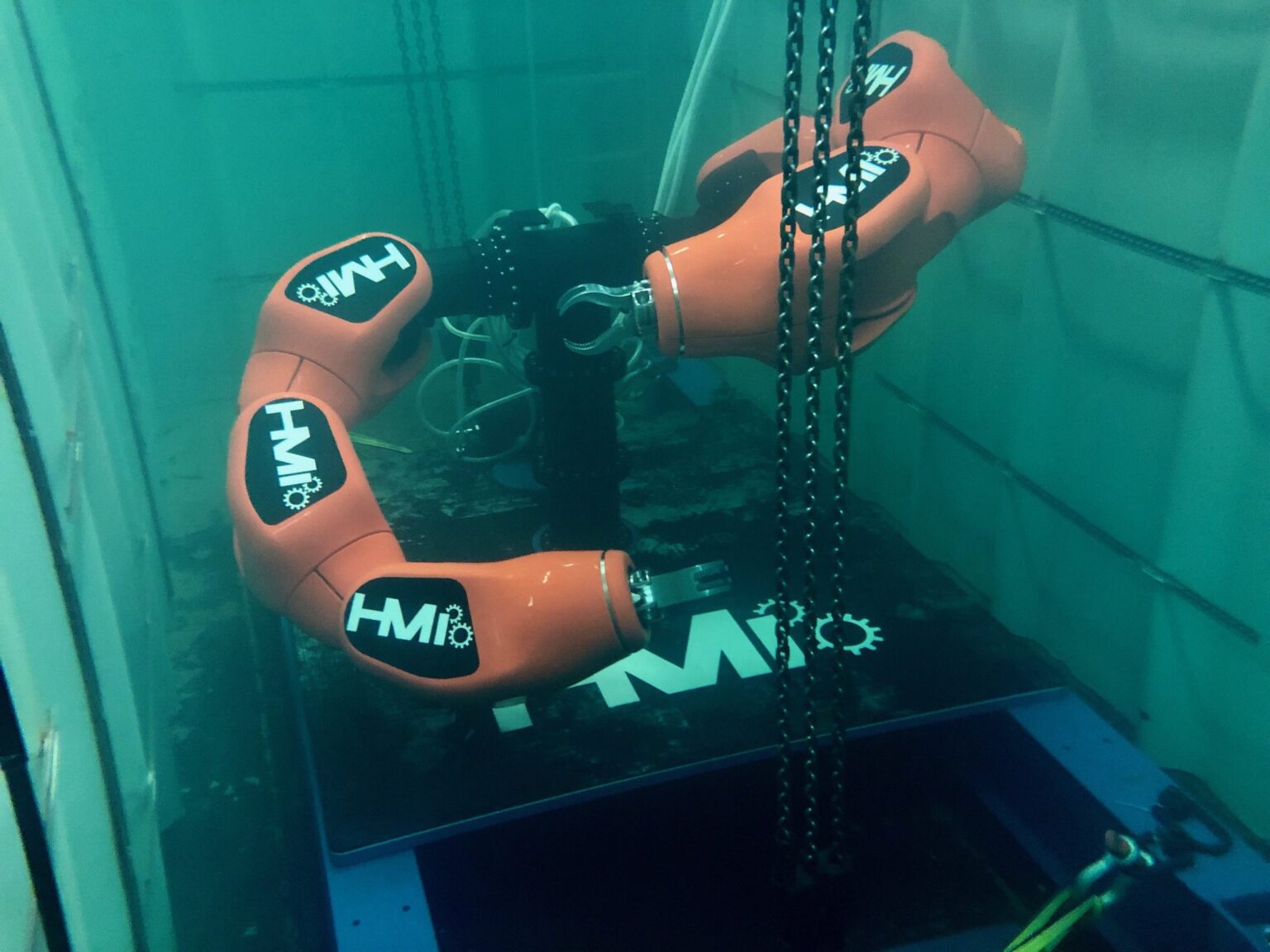

Nauticus develops ocean robots, autonomous software and services for the marine industry. Its products include the flagship Aquanaut robot that can act as an autonomous underwater vehicle (AUV) or a remotely operated vehicle (ROV), the Hydronaut, an autonomous or remotely controlled small vessel, and the Olympic Arm, a robotic arm subsea tool. The company also offers ToolKITT, its robotics control software.

“The closing of this business combination represents a pivotal milestone in our company’s history as we take public our pursuit of transforming the ocean robotics industry with autonomous systems,” Nicolaus Radford, the founder and CEO of Nauticus, said. “Not only is the ocean a tremendous economic engine, but it is also the epicenter for building a sustainable future. Our robotic fleet of Aquanauts and Hydronauts powered by our autonomy software platform, ToolKITT, will significantly reduce emissions, offshore personnel, and costs for our customers. The capital raised in this transaction from both new and existing investors will enable us to deliver the start of this fleet and accelerate our growth trajectory. I would like to give a heartfelt thank you to the Nauticus and CLAQ teams for their tireless work throughout this process as we begin demonstrating our execution and capabilities on the public stage.”

The deal was first announced in December 2021 and valued Nauticus at $560 million. The newly combined company will operate under the name Nauticus Robotics, and will be led by Radford and Nauticus’ current executive team.

All remaining CleanTech or “CLAQ” units will be separated into their underlying components, one share of CLAQ common stock, one right, and one-half of one warrant. All of the rights will be automatically converted into one share of common stock. The transaction was approved by CLAQ stockholders at a special meeting earlier this month.

CleanTech’s financial advisors include Chardan Capital Partners, Lake Street Capital Markets and ROTH Capital Partners. Chardan acted as the sole placement agent on the private placement of public equity. Loeb & Loeb LLP acted as the legal advisor to CleanTech, while Winston & Strawn LLP acted as the legal advisor to Nauticus.

“We are pleased with this outcome that takes Nauticus public and allows them to further their mission of positively impacting the cost and emission profiles of the massive ocean economy,” Eli Spiro, former CEO of CleanTech, said. “I continue to believe Nauticus’ Robotics-as-a-Service business model will be appealing to public markets investors and have confidence in their long-term growth trajectory.”

Brianna Wessling

Brianna Wessling is an Associate Editor, Robotics, WTWH Media. She joined WTWH Media in November 2021, and is a recent graduate from the University of Kansas. She can be reached at bwessling@wtwhmedia.com

LATEST NEWS

WHAT'S TRENDING

Data Science

5 Imaginative Data Science Projects That Can Make Your Portfolio Stand Out

OCT 05, 2022

SOURCE: HTTPS://INTERESTINGENGINEERING.COM

APR 24, 2024

SOURCE: HTTPS://WWW.THEROBOTREPORT.COM/

NOV 16, 2023

SOURCE: HTTPS://WWW.OPP.TODAY/

NOV 01, 2023

SOURCE: HTTPS://WWW.THEROBOTREPORT.COM/

OCT 02, 2023

SOURCE: HTTPS://WWW.SCIENCEDAILY.COM/

SEP 13, 2023

SOURCE: HTTPS://WWW.SMART-ENERGY.COM/

AUG 28, 2023