Coinbase Expands Multi-Chain Support, Integrates Polygon (MATIC) Network for USDC Deposits

SOURCE: HTTPS://THECURRENCYANALYTICS.COM/

OCT 11, 2023

Australia takes next step towards promised overhaul of cryptocurrency regulations

SOURCE: NEWS.COM.AU

MAR 20, 2022

Australia will make its next move towards regulating cryptocurrency after the government promised the biggest overhaul of the nation’s payment systems since the early days of the internet.

A taxation system for cryptocurrency, protections for investors from unscrupulous dealers and methods of regulating digital banks, crypto exchanges and brokers are all on the table under the proposed changes.

“The government can’t guarantee your crypto any more than it can guarantee a painting or a share in a company, and nor should it,” Financial Services Minister Jane Hume said on Sunday.

“But we can make sure Australian exchanges, custodians and brokers – Australian players in the crypto ecosystem – work within a regulatory framework that is better, safer and more secure.”

Treasurer Josh Frydenberg flagged the reforms in December, announcing that the Morrison government would look to make the biggest changes to the sector in 25 years.

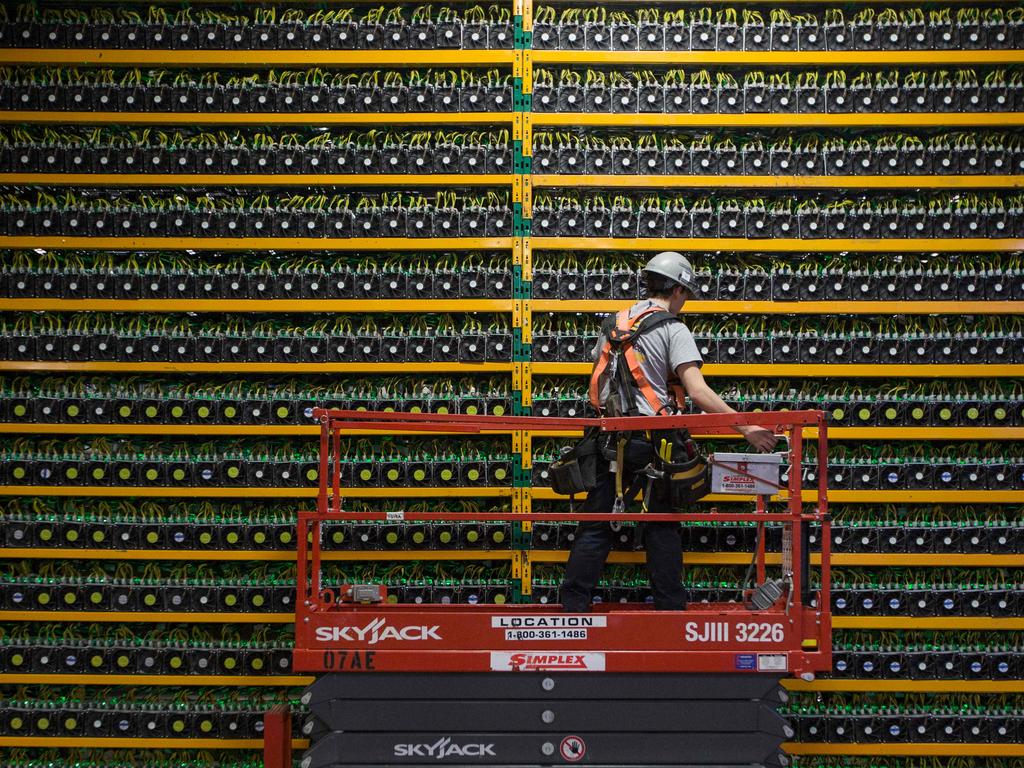

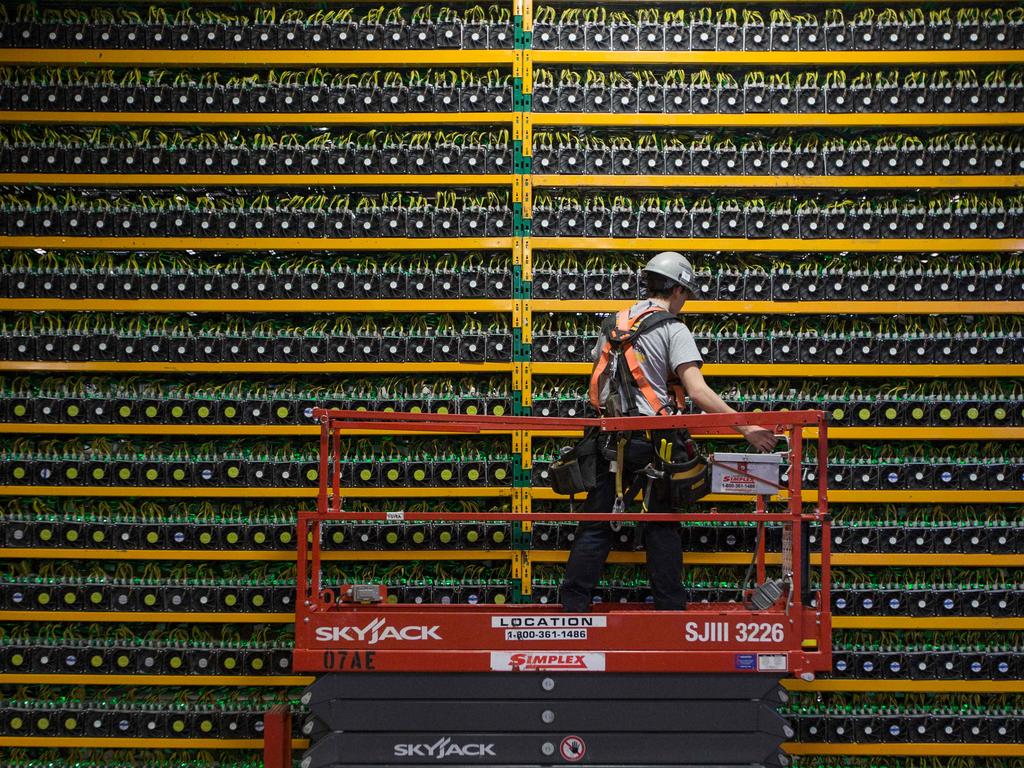

Survey data suggested up to one quarter of Australians had used cryptocurrency, which is ‘mined’ on servers like the ones pictured here. Picture: Lars Hagberg / AFP)

The reforms are to include a number of recommendations from Senator Andrew Bragg’s parliamentary report into the sector, which found Australia’s current regulations were not fit for purpose.

The government will on Monday release three key documents as it begins consulting with the sector, as it is seeking to implement many of the reforms by the end of this year.

Among these documents is a paper seeking the industry’s views on approaches to the development of a licensing and custody regime for digital assets.

Treasury had been considering forcing cryptocurrency exchanges to hold the assets of Australian investors onshore – with some potential exceptions – as part of this custody regime.

The government on Monday will also release the terms of reference for two separate investigations into the sector by the nation’s competition and finance watchdog agencies.

Financial Services Minister Jane Hume made the announcement on Sunday. Picture: Traynor/AFL Photos/Getty Images

The Council of Financial Regulators (CFR) and the Australian Competition and Consumer Commission have been tasked with examining “de-banking” in the digital realm of fintech.

The practice occurs when a bank declines to offer or continue to provide a banking service to a customer, which can have devastating consequences.

The CFR will discuss ways to resolve fintech de-banking when it next meets on Friday, before it presents a final paper to the government in June.

The Board of Taxation (BoT) will review an appropriate policy framework for the taxation of digital transactions and assets in Australia, reporting to the government by the end of this year.

The Morrison government says the BoT will have to consider how to tax cryptocurrencies without increasing the overall tax burden.

Survey data from 2021 suggested that 25 per cent of Australians held or had previously held cryptocurrencies, making Australia one of the biggest adopters of cryptocurrencies on a per capita basis.

LATEST NEWS

WHAT'S TRENDING

Data Science

5 Imaginative Data Science Projects That Can Make Your Portfolio Stand Out

OCT 05, 2022

SOURCE: HTTPS://THECURRENCYANALYTICS.COM/

OCT 11, 2023

SOURCE: HTTPS://FORKAST.NEWS/

SEP 25, 2023

SOURCE: WWW.BUSINESSTODAY.IN

AUG 11, 2023

SOURCE: HTTPS://COINTELEGRAPH.COM/

JUL 19, 2023

SOURCE: HTTPS://WWW.BUSINESS-STANDARD.COM

JUL 06, 2023