Mark Zuckerberg says Meta wearables that read brain signals are coming soon

SOURCE: COINTELEGRAPH.COM

APR 19, 2024

Wearables: What’s the Future of Watches, Rings & Bracelets in Payments?

SOURCE: THEFINANCIALBRAND.COM

APR 20, 2022

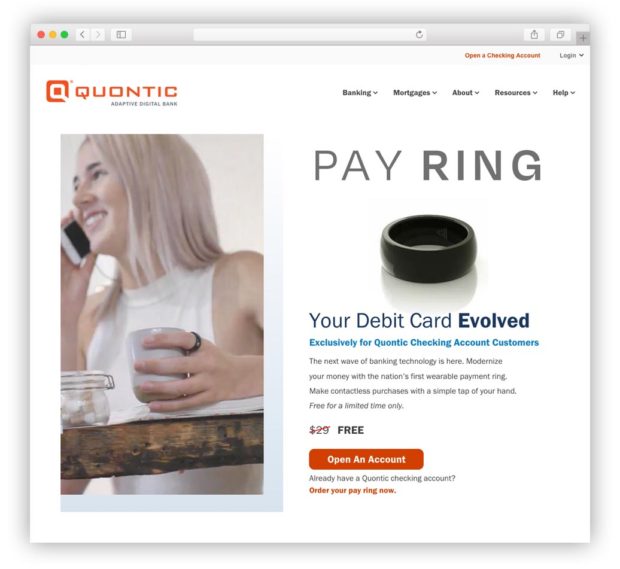

The pandemic's emphasis on contactless payments left a legacy of renewed interest in wearable payment devices that people used to see as novelties. New York's innovative Quontic Bank has launched a Pay Ring that may indicate how quickly wearables will take off.

By Steve Cocheo, Executive Editor at The Financial Brand

Quontic Bank is a small New York City digital-first institution that likes to innovate. In fact, its tagline is “The Adaptive Digital Bank” and it was a crypto pioneer in offering Bitcoin rewards on its checking accounts. Its latest move is the introduction of what’s believed to be America’s first-ever payment ring, a piece of functional jewelry that serves as a wearable debit card. It can be used anywhere that tap and pay service is available.

Quontic introduced its “Pay Ring” in April 2022. At present the rings are available as simple black bands in a range of sizes that are fitted to customers who opt into the new service.

Steven Schnall, CEO and Founder of Quontic, explains that one wrinkle in offering a debit payment ring is that fingers come in multiple sizes so an inventory of them — 20 in all — must be maintained, with extras for the most common ones. Adding another color or two would double or triple the necessary inventory, so for now it’s basic black for everyone. (The inside of the ring is inscribed with the bank’s Q logo, the Mastercard logo, and the logo of the U.K. manufacturer, McLear.)

“We want to see what kind of consumer adoption and excitement we can build around the product before we go all in on inventory,” says Schnall. “There’s no data around customer adoption of this here because this is the first time it’s being tried in the U.S. It’s part of our effort to differentiate from other banks, especially among digital ones where it’s becoming more and more crowded.”

The bank’s debit ring, tied to a choice of three different checking accounts, is wholly Quontic’s product.

“You hear banks talking about being ‘top of wallet’ or ‘front of wallet’ with cards,” says Schnall. “But our thesis is to skip the wallet altogether by being right on somebody’s hand. Then there’s a much higher likelihood that they’ll use our debit card, because to use another they’ll have to haul out their wallet.”

The CEO says he’d been in Europe just before the public launch with a Quontic ring that had already been enabled. Contactless readers for cards are much more common in Europe, he says, but people were still impressed by the ring and wanted to know how to get one. (See The Financial Brand‘s own test drive at the end of this article.)

In everyday use, Schnall says he uses his Pay Ring every morning when he boards the New York City subway to go to the office.

“I’m usually carrying a cup of coffee and maybe something else and with the ring I don’t have to reach for my wallet and pull out my debit card nor open Apple Pay on my phone. It’s not like using a contactless card is complicated, but the ring makes it super easy.” An associated app tracks transactions and other data.

Interestingly, in the act of tapping, there is contact with surfaces. But as a veteran payments banker recently told The Financial Brand the public’s conception of “contactless” has been evolving since the early days of the pandemic. Back then, people wore plastic gloves or used cotton swabs to punch the buttons on payment terminals and ATMs and avoided handing their credit or debit cards to anyone. Now the feeling seems to be that so long as you don’t touch the cashier, you’re in the clear, the executive said.

Quontic’s experiment began with staff and debuted in April 2022 with an email offer to about 10,000 checking customers. Schnall says about 15% said they wanted a ring — a $29 cost that the bank is waiving for now — and most have ordered rings in their sizes.

Schnall thinks rings will work over something like bracelets, which at least one financial services company in the U.S. tried and withdrew. “Not a lot of people wear bracelets, and they are more of a fashion choice,” says Schnall. “But rings are widely acceptable to most.”

He and his wife wear theirs on the wedding band fingers. The pay rings match, of course, “so it’s kind of cool,” says Schnall. Down the road one possibility is prepaid ring “gift cards.” Another would be team-oriented rings.

LATEST NEWS

WHAT'S TRENDING

Data Science

5 Imaginative Data Science Projects That Can Make Your Portfolio Stand Out

OCT 05, 2022

SOURCE: COINTELEGRAPH.COM

APR 19, 2024

SOURCE: HTTPS://INTERESTINGENGINEERING.COM/

NOV 16, 2023

SOURCE: HTTPS://WWW.AZOSENSORS.COM/NEWS

AUG 28, 2023

SOURCE: WWW.WHATGADGET.NET

JUL 11, 2023

SOURCE: HTTPS://WWW.THEHINDU.COM/SCI-TECH/TECHNOLOGY/INDIAS-WEARABLE-MARKET-GREW-47-IN-2022-BOAT-MAINTAINS-LEAD-REPORT/ARTICLE66493121.ECE

JUN 30, 2023