Mahindra Lifespaces unveils India’s first home buying experience on the Metaverse

SOURCE: HTTPS://INDIATECHNOLOGYNEWS.IN/

OCT 31, 2023

Roblox Is A Great Metaverse Growth Opportunity

SOURCE: SEEKINGALPHA.COM

FEB 06, 2022

My main portfolio is my dividend growth portfolio. I analyze dividend growth companies that fit the strategy, and I also publish a quarterly update regarding my portfolio's performance and holdings in an attempt to be as transparent as I can with my readers. In addition to my dividend growth portfolio, I also hold a smaller Roth IRA portfolio which is focused on growth stocks.

In this portfolio, I own stocks, ETFs, and mutual funds across sectors that are focused on growth stocks of all market caps. In this article, I will analyze my favorite Metaverse stock, and probably one of my favorite growth stocks especially after the shares have plummeted lately when the volatility was high. This company is Roblox (RBLX).

I cannot analyze the company using the same methodology I use for analyzing dividend growth opportunities. However, I will use the same roadblocks I use when I analyze other stocks. I will look into the company's fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it's a good investment.

According to Seeking Alpha's company overview, Roblox Corporation develops and operates an online entertainment platform. It offers Roblox Client, an application that allows users to explore 3D digital worlds, and Roblox Studio, a toolset that allows developers and creators to build, publish, and operate 3D experiences and other content. The company also provides Roblox Cloud, a solution that provides services and infrastructure to power the human co-experience platform.

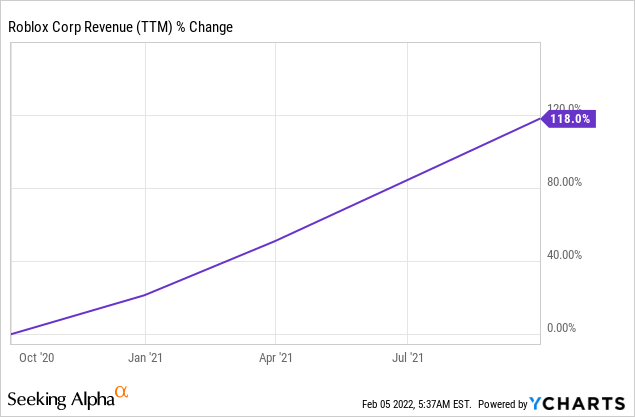

Revenues are the first metric I look at when it comes to growth companies. The risks that are inherent to growth companies should be mitigated by fast revenue growth. Roblox has seen its revenues increasing significantly over the last year with sales doubling. Sales growth is derived from the increase in daily active users as well as an upgrade in the plans acquired by users and developers. The company is focusing on organic growth, and according to Seeking Alpha's analysts' estimates, the company will keep growing at 20%+ annually.

Data by YCharts

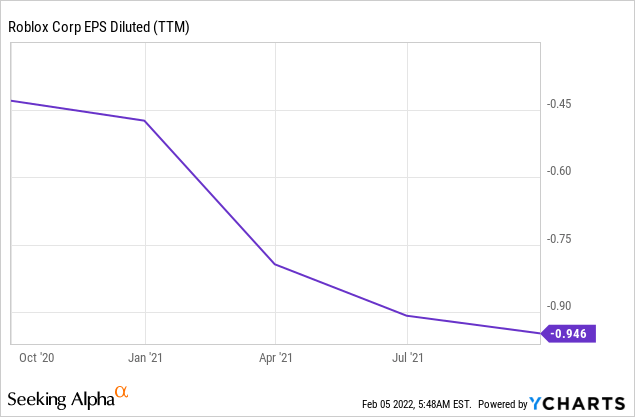

While the company is growing its revenues, it still has not found the path for profitability. The company is investing heavily in its product through R&D expenses, developer fees, and its infrastructure. All these are growing slower than revenues, and therefore, the company is expected to reach profitability in the medium term, as revenues continue to increase faster than expenses.

Data by YCharts

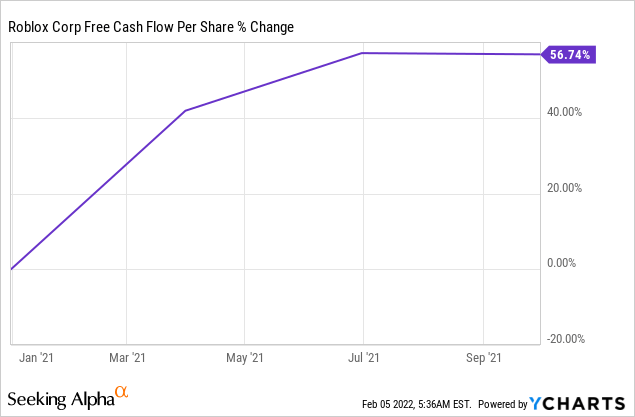

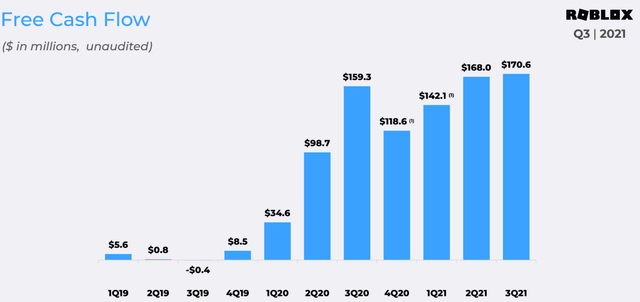

While the company is not profitable, due to the past expenses being deprecated, the company is producing positive FCF. The company has been doing so since Q4 2019, and since then the FCF has increased significantly, and reached an all-time high of $170M in Q3 2021. A growth company that can show positive free cash flow should not be taken for granted, and it shows how strong the company's prospects are, as it generates cash while growing that fast. The positive FCF also protects it from relying on debt and equity markets to raise funds.

Data by YCharts

Roblox is not only creating cash flow, it also creates it with significant margins. Its FCF margin is above 20% and its adjusted EBITDA margin is 25%. The company's margins are impressive as other peers are struggling to even become profitable, the company is enjoying a high level of profitability, which shows resiliency and that the company's position is strong, as it can wither compete on pricing or increase expenses to grow even further.

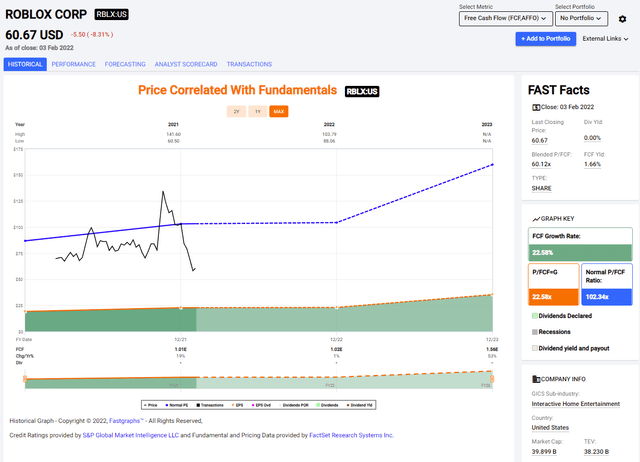

The company is trading for roughly 10 times its forecasted sales for 2022, and therefore, it is not cheap by any means. The company's price dropped by 50% yet the valuation is still not cheap. However, when we take into account the growth rate of the company, it is a more promising story for investors.

The graph below from Fastgraphs.com shows that the company is trading for 60 times its FCF in 2021 and 2022. While this valuation is not cheap when sales are growing at more than 20% annually, this challenging valuation makes sense despite the significant risks involved with so little margin of safety.

Fastgraphs.com

To conclude, Roblox is your best-of-breed growth company. The company is growing revenues, but unlike most peers, it is also growing free cash flow. Investors buying shares in Roblox will enjoy future growth, and they will buy it for a high valuation that can be justified if the vision of Roblox will materialize in the medium and long term.

The Metaverse will serve as the growth platform for Roblox. Unlike some peers who only now start to pay attention to the Metaverse as a concept, and the ability to shift a growing portion of our lives online, Roblox is poised for this growth. It already has a developer platform, it has the experience and above all, it has an existing user base with daily active users approaching 50M people worldwide and still growing at a double digits rate. This existing platform, ecosystem, and client base will be the building blocks of Roblox Metaverse vision.

Long-term, the vision for brands is the exact same as games or play experiences, in that we imagine an ecosystem where there are thousands and thousands of these experiences. They are created in concert between brands and possibly creators and developer communities. But just as 16 years ago, gains in play experiences were new on Roblox. This is relatively new for some of them.

(David Baszucki, Roblox CEO, Q3 Earnings Call)

Improving profitability is another important opportunity. Usually, when investors buy growth stocks, they take immense risks to buy future cash flows that will materialize. Roblox is unique in the fact that the company is already achieving positive free cash flow that is growing significantly. Despite having negative EPS as the company is still investing heavily, the positive cash flow makes it much less sensitive to market volatility and gives investors a solid ground to rely on.

Roblox Q3 Earnings

The company has been building this platform for 16 years. After a long investment time, the company is now ready to capitalize on the tailwinds in the gaming industry and the communication world. The growing crowds for gaming, especially young people are turning into a community. This community is growing as fiber optics and 5G technologies increase the availability of fast internet, coding and gaming becoming more popular, and investors show interest in the Metaverse. The combination of Roblox products with real-world trends will push future earnings forward.

We've been building this platform for over 16 years. And one of the keys is that it's powered by user-created content, millions of creators who make everything on Roblox. As we've grown up, too, as we've improved the quality of our personalized search and discovery, more and more, the people on our platform are finding amazing content that is very aligned with what they're looking for. And our creator community is very responsive to the wants and needs of the player community.

(David Baszucki, Roblox CEO, Q3 Earnings Call)

The Metaverse is still a concept that has nothing tangible to show for. The internet infrastructure in the western world can finally support this idea and transfer more use cases online, but there are still no actual use cases. Nobody knows how the Metaverse will look, what the consumers want to adopt. So far we have many visions that can turn into successes, but nothing is guaranteed, and it is far from monetization.

The second risk is the margin of safety. The company is generating real free cash flow, and it means that investors are dealing with fewer risks. However, the current Price to FCF is still high at 60. This is not high when taking into account the growth forecasts, but if for some reason the company is unable to keep growing, whether it's the competition, or consumers not adopting its vision, the valuation that may make sense right now, will be an outrageous one, and a swift correction may happen.

A third risk is a systematic risk that has nothing to do with the company's operation, but it may affect investors significantly. The Federal Reserve is going to raise the interest rates. This is almost a fact accepted by almost all investors. A faster than anticipated rate increase may hurt the company's valuation. The discount rate will increase quickly, and with the current valuation, investors may see short-term price decrease even if the company is performing extremely well.

Roblox is a great company with great growth prospects. The company has grown revenue, and it generates free cash flow from its revenues. The company's valuation while high, is justifiable when taking into account future growth and the positive free cash flow.

The big question mark regarding Roblox is the Metaverse. If it materializes, and Roblox manages to add its vision, there is room for significant growth. If you believe, that a larger portion of our life will migrate online due to better internet infrastructure, then Roblox will continue to perform well, and grow revenues and FCF. I am bullish on Roblox after it plummeted over 50%.

This article was written by

LATEST NEWS

Augmented Reality

Hi-tech smart glasses connecting rural and remote aged care residents to clinicians

NOV 20, 2023

WHAT'S TRENDING

Data Science

5 Imaginative Data Science Projects That Can Make Your Portfolio Stand Out

OCT 05, 2022

SOURCE: HTTPS://INDIATECHNOLOGYNEWS.IN/

OCT 31, 2023

SOURCE: HTTPS://FINANCE.YAHOO.COM/

SEP 28, 2023

SOURCE: HTTPS://MEDIABRIEF.COM/

SEP 22, 2023

SOURCE: HTTPS://WWW.BUSINESS-STANDARD.COM/INDIA-NEWS/METAVERSE-WEB3-MARKET-TO-GROW-40-ANNUALLY-TO-REACH-200-BN-BY-2035-123060200394_1.HTML

JUN 28, 2023

SOURCE: HTTPS://WWW.WIRED.COM/STORY/WHAT-IS-THE-METAVERSE/

JUN 20, 2023