UK becomes first to approve Casgevy genetic therapy for blood disorders

SOURCE: HTTPS://INTERESTINGENGINEERING.COM/

NOV 17, 2023

Europe Trailed US Despite Record Gene and Cell Therapy Funding in 2021

SOURCE: LABIOTECH.EU

JAN 14, 2022

Cell and gene therapy developers globally raised an all-time annual record in 2021. However, European firms missed out on the funding growth.

Companies around the world developing cell and gene therapies raised €20.1B ($23.1B) over 2021, said the advanced therapy advocacy organization the Alliance for Regenerative Medicine (ARM) in a briefing this week. This bumper catch beat 2020’s total of €17.3B ($19.9B) by 16%.

Funding raised globally by developers of cell and gene therapies by year. Credit: ARM

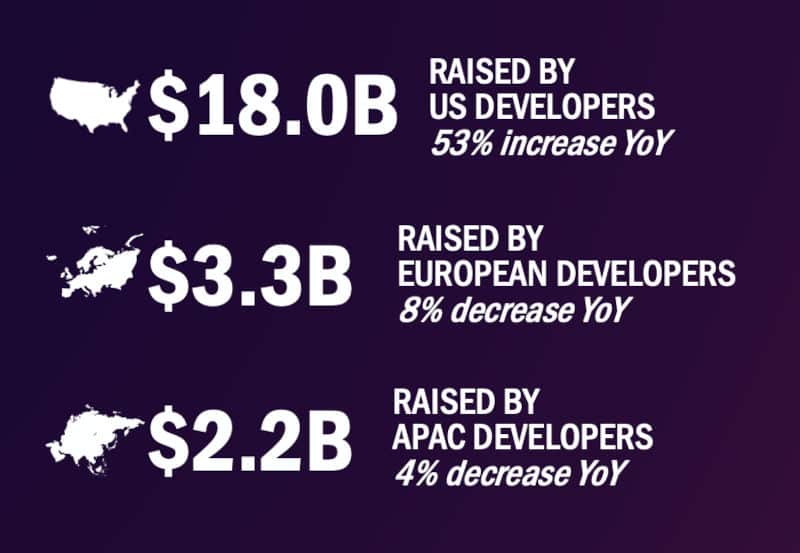

The growth from 2020 to 2021 was primarily driven by companies in the US. With a fresh €15.7B ($18B) in the bank, US-based companies saw an impressive 53% jump in investments compared to 2020. In contrast, their European counterparts raised €2.9B ($3.3B), 8% less funding than in 2020.

Funding raised in 2021 by developers of cell and gene therapies by region. YoY: Year on year from 2020. Credit: ARM

Both European and US gene and cell therapy players had seen record funding growth in 2020 compared to 2019, said Stephen Majors, ARM’s Director of Public Affairs. However, it’s too early to establish why European and Asian companies haven’t matched the rapid cash growth seen in the US over 2021.

“It’s something we’ll watch closely over the next year to determine what the causes may be and whether they are region-specific,” said Majors.

Nonetheless, the funding numbers need to be interpreted in the correct context, said Antoine Papiernik, Chairman and Managing Partner of the venture capital (VC) firm Sofinnova Partners. European contributions to the field of cell and gene therapy remain immense.

“It’s not about how much you raise in one year; it’s about the level of expertise, competencies, and technologies,” said Papiernik. “These are the fundamentals for long-term excellence and growth, which we strongly believe in.”

“If there is one area where Europe is, without a doubt, on par with the US, it’s in new modalities, which include gene and cell therapies.”

Of the various funding sources going to cell and gene therapies, VC funding increased the most in 2021, with a huge 73% jump to €8.5B ($9.8B). This trend mirrored the deluge in life sciences VC funding in the last year.

Simultaneously, gene and cell therapy companies were hit by struggling stock markets affecting the rest of the biotech sector. This mismatch is creating a bulge in funding for VC firms and potentially limiting exit options.

“Inflation concerns made it particularly difficult for smaller, early-stage companies that are not yet profitable,” said Majors. “If inflation concerns subside in 2022, and with positive data readouts, we could see stronger performance for biotech public equities.”

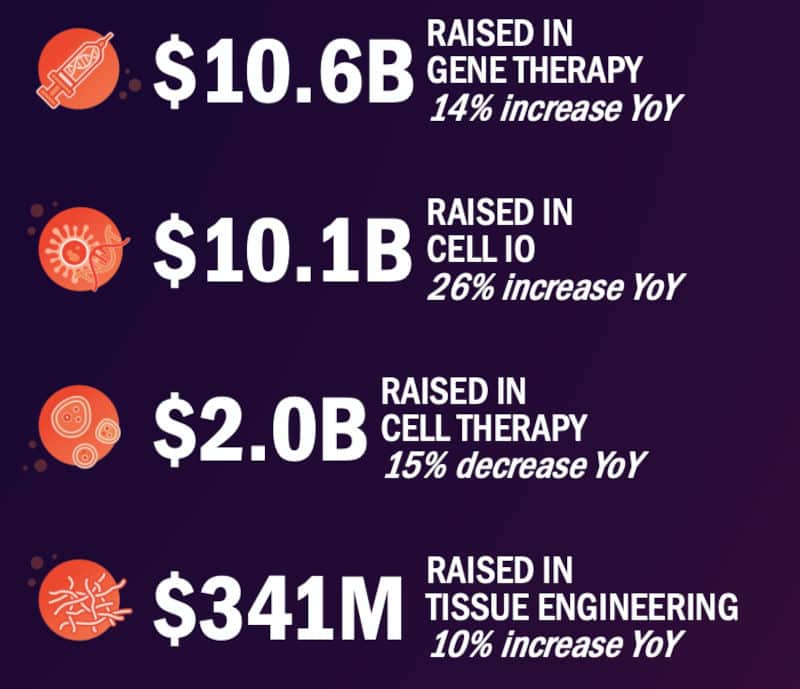

When the total is broken down by the types of technology getting funded, cell therapies in immuno-oncology such as CAR-T cell therapies saw the biggest funding increase: a jump of 26% since 2020. This was followed by gene therapy firms with 14% more incoming cash, and tissue engineering players, whose investments went up by 10%.

Funding raised globally in 2021 by developers of cell and gene therapies by technology. YoY: Year on year from 2020. Cell IO: cell therapy in immuno-oncology. Credit: ARM

Cell therapy companies outside of immuno-oncology experienced a tighter year for financing in 2021 than in 2020, taking in 15% less funding at €1.7B ($2B). However, Majors told me that funding in this field has regularly fluctuated in the last several years.

“The decrease over 2021 is not an outlier in comparison to historical trends,” Majors noted. “Due to the smaller size of this technology segment, just one or two financing deals can have a large impact on total financing on an annual basis.”

Another important trend in the ARM’s report was the rising importance of gene-editing technology. Of the total gene therapy financing, 45% was raised by companies developing gene-editing technology, up from 38% in 2018.

Investor interest in gene editing has been buoyed by clinical successes from frontrunner gene therapy players in the last year. One example from June 2021 was the promising performance of an in vivo CRISPR treatment developed by Intellia Therapeutics and Regeneron in patients with the rare disease transthyretin amyloidosis.

Gene-editing firms CRISPR Therapeutics and Vertex Pharmaceuticals are causing excitement with progress in tackling the blood disorder sickle cell disease. They are gunning to file for approval of their CRISPR gene-edited therapy for this condition in late 2022.

“Investors have taken note of these early successes and see this approach’s potential to treat a wide range of diseases,” said Majors. “Also, as this technology continues to progress, the number of companies with at least one clinical or preclinical asset in gene editing continues to rise.”

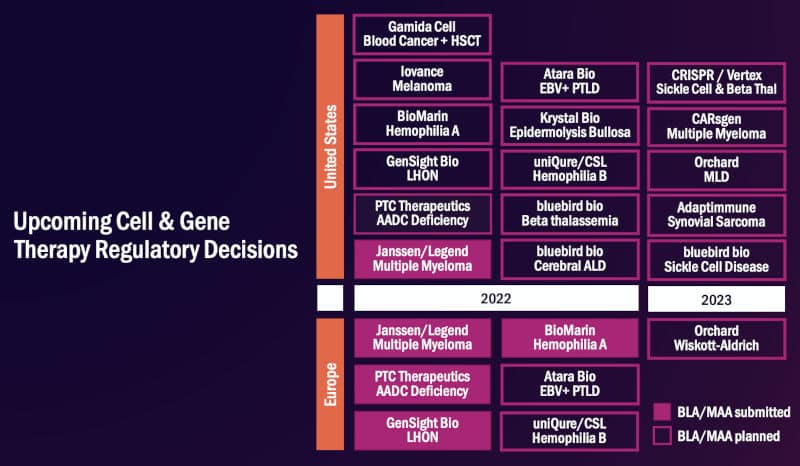

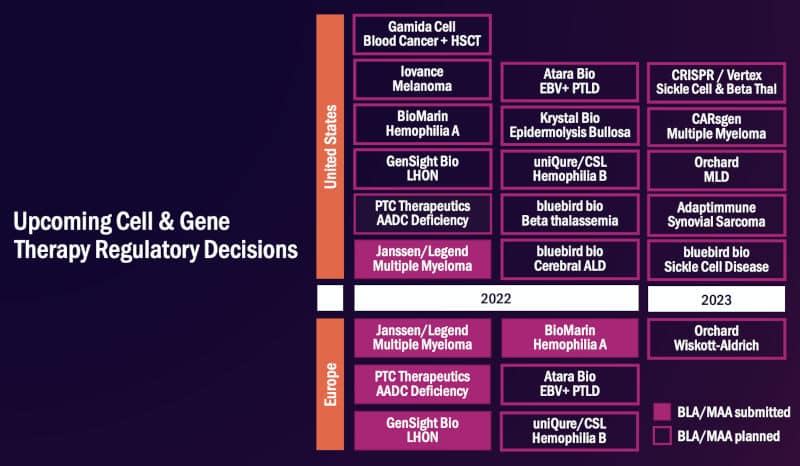

Another outcome to look forward to for gene and cell therapy in 2022 is a potential record number of drug approvals. A bunch of gene therapy hopefuls including GenSight, uniQure, and BioMarin are poised to bring their candidates to the regulatory finish line in the US and Europe.

Upcoming approvals of cell and gene therapies in 2022. Credit: ARM

“The EMA is slated to make decisions on therapies targeting aromatic l-amino acid decarboxylase deficiency, Leber hereditary optic neuropathy, and two types of hemophilia,” said Majors. “By the end of 2022, the number of EMA-approved gene therapies for rare diseases may have doubled from a year earlier.”

However, some of the major hurdles for the field will likely be the delivery of gene and cell therapies to their target in the body as well as deciding the right dosage. The manufacture of these complex therapies is also a big bottleneck that many startups aim to tackle.

Additionally, the withdrawal of bluebird bio’s gene therapy from Germany in May 2021 over pricing disagreements demonstrates that regulatory approval is just the beginning for developers of gene and cell therapies. Their pricing strategy will need to walk the tightrope of making a profit while avoiding clashes with healthcare systems.

In any case, European companies will continue to play a strong role in the evolution of the cell and gene therapy sphere.

“Let’s not forget that the first gene therapy to be brought to the market was European,” said Papiernik, referring to the gene therapy Strimvelis, which was sold by GlaxoSmithKline to Orchard Therapeutics in 2018.

“Europe continues to excel in the development of gene and cell therapies and never has there been more opportunities for investment.”

LATEST NEWS

Artificial Intelligence

Eerily realistic: Microsoft’s new AI model makes images talk, sing

APR 20, 2024

WHAT'S TRENDING

Data Science

5 Imaginative Data Science Projects That Can Make Your Portfolio Stand Out

OCT 05, 2022

SOURCE: HTTPS://INTERESTINGENGINEERING.COM/

NOV 17, 2023

SOURCE: HTTPS://GENETICLITERACYPROJECT.ORG/

SEP 05, 2023

SOURCE: HTTPS://WWW.SCIENCEDAILY.COM/

AUG 07, 2023

SOURCE: HTTPS://WWW.SCIENCEDAILY.COM/

JUL 24, 2023

SOURCE: HTTPS://NEWS.MIT.EDU

JUL 20, 2023

SOURCE: BIOSPACE.COM

OCT 27, 2022